Whether you're a contract planner like myself, a junior associate, or a paraplanner, understanding the advisor's needs is crucial for success. To kick off the planning process, I need to define what the advisor wants and how they want it. This varies from advisor to advisor, so I refer to them as "The House Rules". In a W2 scenario, these rules can be learned gradually over time, but in a contractor arrangement like a Fractional Planning engagement, time is limited, making trial and error costly and inefficient. Therefore, I request that this information be provided upfront as much as reasonably possible. There is still a learning curve involved, but I'm looking to shorten the duration of that curve as much as I can.

Capital Market Assumption (CMA) – Planning software normally comes with the CMA’s pre-populated by the software provider, but the advisor can change them manually if they wish. The advisors should be certain they know what the CMA’s are and be ok with using them.

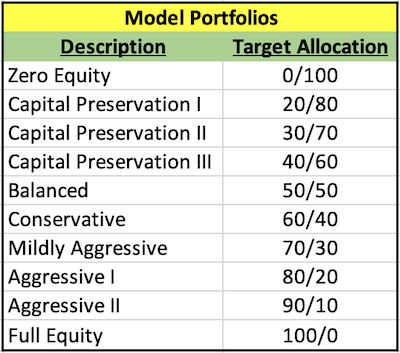

Model Portfolio (MP) – Planning software also comes with a set of MPs from the developers, but, like the CMA’s, an advisor can create custom versions of these for their own target portfolio allocations. The MP should be named in some fashion that reflects their contents in an obvious way, or the advisor should provide a table where we can look up values for appropriate use. If the advisor were to create a model called “Capital Preservation”, somewhere that needs to be defined as a 40/60, or even 30/70 portfolio allocation, etc. If there are any MPs that the advisor specifically does not want me to use, that needs to be made clear as well. An example table provided by the advisor could be as simple as this:

Inflation Rates – All advisors have their opinions on base inflation rates that should be used in planning as well as modified inflation rates based on certain categories. Healthcare inflates at a different rate than base, as do college costs, etc. The advisor needs to define these rates up front and provide them prior to the project's beginning. The advisor wants projections to be done right the first time and the inflation rates will definitely impact the results significantly.

Assumed Rates of Return or Depreciation – Various asset-type valuations can change, positively or negatively, depending on the advisor's research and opinions of the potential of those assets. Those changes can also be location dependent, such as the inflation of real estate values in Southern California versus the Midwest, etc. These various rates should be agreed upon and conveyed at the beginning of the planning process or the engagement and reviewed periodically.

Planning Software “Work Arounds” – Every planning software platform does things differently or sometimes not at all, so some discussion about those items should happen in advance as much as possible. Questions will certainly arise that will have to be answered in real-time, and both the advisor and employee/contractor must be ok with this eventuality.

Example: If a client is going to sell their current primary home as part of the plan, does the planning software being used properly account for the federal tax exclusion on the sale of a primary home? If not, how does the advisor prefer that to be accounted for in their planning process?

House Rules - Personally, I would usually choose two different portfolio allocations: one to be used during the accumulation phase (assuming the client is still in that phase), the other beginning at retirement or distribution phase. These allocations would be selected for their least-risk characteristics that achieve the clients defined planning goals. For example, a 70/30 portfolio during accumulation and a 50/50 at retirement might meet the goals with the least risk, so that would be chosen. If the advisor wishes to use a different approach, that should be discussed at the beginning of the engagement.

Other House Rules can include what assets should or should not be included in a Net Worth statement, how collectibles are treated, how digital assets will be treated and planned for, etc. If the advisor can define as much as possible at the beginning, that would be optimal, but I know that some will be learned on a case-by-case basis. Of course, some items will be learned by finding out what services are covered in the original client engagement agreement the advisor created - if the client didn't ask for insurance reviews (Life, P&C, etc.), then none of that would get included for that particular client.

Discovering and documenting these kinds of data points in advance of starting the planning process is crucial to the perceived success of the engagement with the advisor. Nobody likes being nibbled to death in tiny bits, so the less the support staff, W2 or 1099, has to come back to the advisor for little items of information then the better the process will go.